In other words, it’s the process of understanding who your business is targeting so you can better position your marketing strategy.

In this guide, you’ll learn:

- The role of market research in a marketing strategy

- When to conduct market research

- Types of market research

- Market research methods and their benefits

- How to conduct market research (example included)

- Market research tools and resources

A marketing strategy is a business’s overall game plan for reaching consumers and turning them into customers.

The key word in the above definition is “game plan”. Entering a market with a product is like starting a new game. Since you’re new to the game, you don’t know the rules, and you don’t know who you’re playing against.

This is exactly where market research comes in. Market research allows you to discover the rules of the marketing game by understanding your target audience. Moreover, it allows you to understand who your opponent is by assessing the strengths and weaknesses of your competition.

Research is what marketing pros do to plan their moves, and outperform their competition. It’s also what marketing pros use to identify the strengths and weaknesses of their own marketing strategy.

But is market research the ultimate business oracle? Unfortunately no. Even companies that specialize in market research admit it - here’s a quote from one of them:

(…) it cannot be assumed that market research is an exact science, as it would be unrealistic and unreasonable to expect market researchers to predict the precise demand for a new concept, given that there are numerous variables that can impact demand outside of the market researchers’ remit.

That’s why market research with all of its significance is “only” a part of marketing, and it’s “only” an experiment. It’s up to you whether you will conduct your experiment, and when you will end it.

For example, Crystal Pepsi seemed very promising in the market research phase, yet it failed when released onto the market (a similar thing happened to New Coke). Xerox’s idea for a commercial photocopier was a no-go in the eyes of research analysts; Xerox did it anyway, and the rest is history.

Paul N. Hauge and Peter Jackson in their book “Do Your Own Market Research” point to three specific situations when market research is really useful:

- Setting goals. Knowing things like the size of the market, or defining your potential customers can help you set your sales goals.

- Problem-solving. Low sales? Low profitability? Market research will help you understand whether your problems are internal, like a low-quality product, or external, like aggressive competition.

- Supporting company growth. Understanding how and why consumers decide on products will help you decide what products to introduce to the market.

Another answer to the “when” is the importance of the decision that you need to make. The more important the marketing issue you’re tackling, the more market research comes in handy.

For example, launching a new car on the market is quite a big event, right? So maybe Ford could have avoided losing 350 million dollars with the Ford Edsel if they had done their research properly. I mean, with the right methods in place it shouldn’t be that hard to predict that consumers will deem the car overpriced and ugly.

That said, market research doesn’t always have to be a large, complex project. The relatively new trend of agile market research allows you to research the market regularly and in a cost-effective way. This is where you employ bite-size, iterative, and evolutionary methods to react to fast-changing circumstances and adapt to unknown market territories.

Furthermore, if you’re working in startup conditions, especially if you’re developing an innovative product, you may be interested in customer development. In this methodology market research is at its “agilest” and it’s tightly woven into the product development process.

Take Ahrefs for example. We stick to agile market research hacks anyone can use. As you will see later in the article, we use simple (but effective!) stuff like social media polls, crowdsourcing, in-house competitive analysis, or just tracking the pricing of our competitors.

Case in point, just recently we asked our fellow marketers on Twitter how they go about researching the market. It seems that market research comes in all shapes and sizes:

Have you ever performed “market research?“

— Tim Soulo (@timsoulo) May 3, 2021

What was it for?

Just because somebody does market research in a certain way doesn’t mean that you need to copy that. You should know your options, and they start with the different types of market research.

Primary research

Whenever the research is done by you or on your behalf, and you need to create the data to solve a given problem, that is called primary market research.

Examples: Focus groups, interviews, surveys (more on those later in the article).

Key benefits: It’s specific to your brand and products or services, and you can control the quality of the data.

Secondary research

Whenever you’re using already existing data, such as that put together by other businesses and organizations, you’re doing secondary market research.

Examples: Second-party and third-party sources like articles, whitepapers, reports, industry statistics, already collected internal data.

Key benefits: Get a macro perspective of your marketplace, as secondary research includes other players in the market, and most probably utilizes a bigger set of data than your primary sources.

Primary research vs. secondary research

Primary and secondary market research are different but by no means opposite. It’s actually recommended to use both.

While primary sources will give you a focused, micro perspective of your business, secondary research will tell you how other businesses are doing and how your research findings compare to bigger research sample sizes.

Market research subtypes

A bit more theory for all you marketing geeks out there. Professional market researchers distinguish between the following primary and secondary market research subtypes:

- Qualitative research. Think interviews, open-ended questions, results expressed in words rather than numbers and graphs. This type of research is used to understand underlying reasons, opinions, and motivations.

- Quantitative research. Think surveys, polls, usually closed-ended questions, results expressed in numbers and statistics. This type of research is used to test or confirm hypotheses or assumptions by quantifying defined variables (such as opinions or behaviours) and generalizing results from larger data samples.

Let’s go over some popular market research methods you can use yourself and/or outsource.

Internal data analysis

The data you’ve already collected in your company is an invaluable secondary research data source. The more time you’re in the business, the more data you have on your hands.

The best thing about your internal data is that it’s been put into practice in real-life market conditions, so you just need to find the patterns and draw conclusions.

Here are some internal data sources you can leverage:

- Website data (like Ahrefs’ Web Analytics)

- CRM data

- Past campaigns performance data

- Internal interviews with employees

Interviews

Interviews allow for face-to-face discussions and are great for exploratory qualitative research.

In unstructured interviews, you have an informal, free-flowing conversation on a given set of topics.

In structured interviews, you prepare a detailed, rigorous interview protocol where you list every question you want to ask and you can’t divert from them.

You can also choose the “middle way” with semi-structured interviews which revolve around predefined themes or questions, but allow for open-ended discussion.

A word of advice here would be to always remain neutral and unbiased, even during unstructured interviews. Also, it’s helpful to perform a pilot test of the interview to quickly spot some defects of your protocol.

Recording the interview may influence the answers, so use it wisely.

Focus groups

Focus groups are where 5 to 10 people with common characteristics take part in an interactive discussion with a moderator. They’re used to learn how a particular group thinks about a given issue or to provide feedback on a product.

Now, you might know that Steve Jobs famously hated focus groups. He’s on record saying:

It’s really hard to design products by focus groups. A lot of times, people don’t know what they want until you show it to them.

If you’re trying to create a leapfrog product like the iPhone, there’s probably some validity to this statement. But most of us aren’t wrestling with that level of ambition. We just want to know if customers will like a proposed new feature or not. For this, focus groups are super useful.

Surveys

Surveys involve polling your audience. They’re usually performed online for customer satisfaction and loyalty research, and are one of the most popular and cost-effective market research methods.

Some of the tried and tested use cases of online surveys are:

- Product feature desirability

- User satisfaction feedback

- Quantitative analysis of certain issue occurrences

- Identifying friction points in your customer journey

- Discovering the reasons to convert to or cancel your service

- During product onboarding to create a customer profile (and for marketing automation)

- Opinion about a recently made change

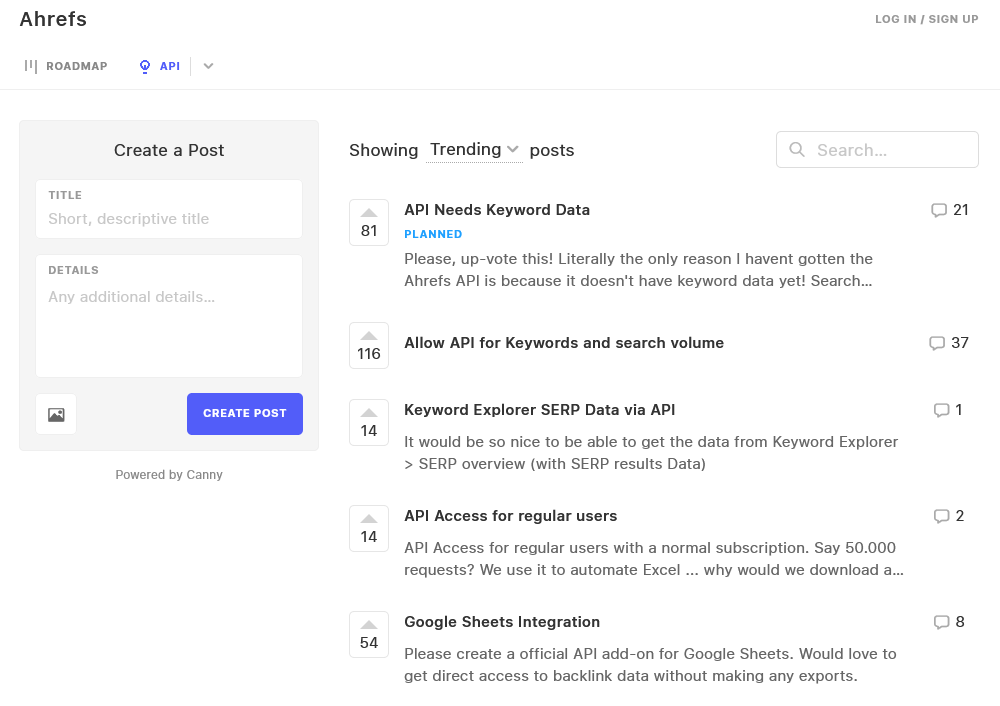

An interesting example of surveying the market is crowdsourcing. That’s what Ahrefs does to understand what features to build, how important they are, and what customers expect from them.

What’s unique about crowdsourcing is that it allows the users to add their own ideas, and upvote or comment on existing ideas rather than answer predetermined questions, so this method leaves less room for marketing myopia. You improve your business, and the users get a better product—everybody wins.

How we crowdsource ideas at Ahrefs

Social media is another great place to survey the marketplace.

How many of you have disavowed links in GSC this year?

— Tim Soulo (@timsoulo) October 8, 2020

Market segmentation

Market segmentation is the practice of categorizing a market into homogeneous groups based on specific criteria, also called segmentation variables (like age, sex, company size, country, etc.).

If you think you’re building a product for everyone, think again. Not everyone will want to buy from you.

Smart companies pick their target audience carefully. They pinpoint groups of people or organizations that could be valuable customers for the business. That way they also discover their non-ideal customers and develop a plan to attract customer segments gradually.

Ever wondered why Procter and Gamble creates so many, often competing, brands? You guessed it: market segmentation. P&G simply divides and conquers. Different people have different needs, so they need different products (and possibly brands).

Competitive analysis

Another powerful, yet often overlooked, market research method is the process of understanding one’s market environment. Seriously, if there’s only one thing you could do to learn what works and what doesn’t in your market, you should do a competitive analysis.

“Whenever we discuss building a certain feature, we would definitely research our competitors and see how they do it.”

You’d be surprised by how much you can learn about and from your competition and how much of it can be done online. There are certain tried and tested techniques, hacks, and tools for this type of research, and you can find them in this guide.

Analyze commercial data

Secondary market research data is relatively affordable, fast to acquire, and easy to use. Think market reports, industry insights, and a ton of research data someone has already gathered and analyzed so you don’t have to.

The most reputable sources are Gartner, Forrester, and Pew. Apart from those, make sure to check if there is a trustworthy commercial data source specific to your niche.

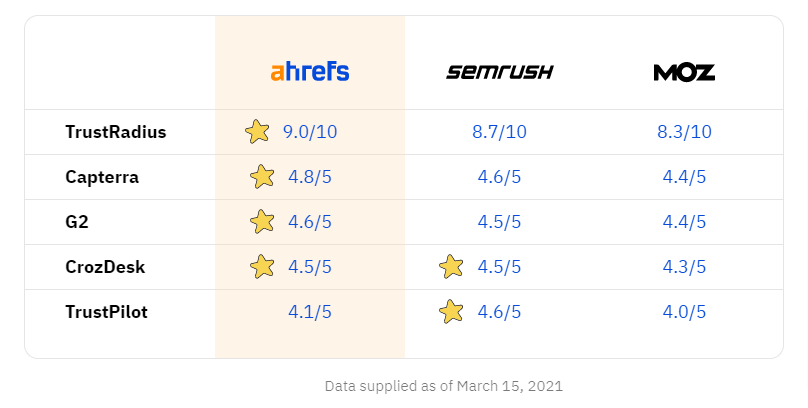

Sites like G2, Capterra and Trust Pilot also count. Not only do they give you an overview of your industry, but you can also find some real gems in your users’ reviews and your competitors’ reviews as well. Ahrefs uses that data source regularly internally and externally, like for this section of our Ahrefs vs Semrush vs Moz landing page:

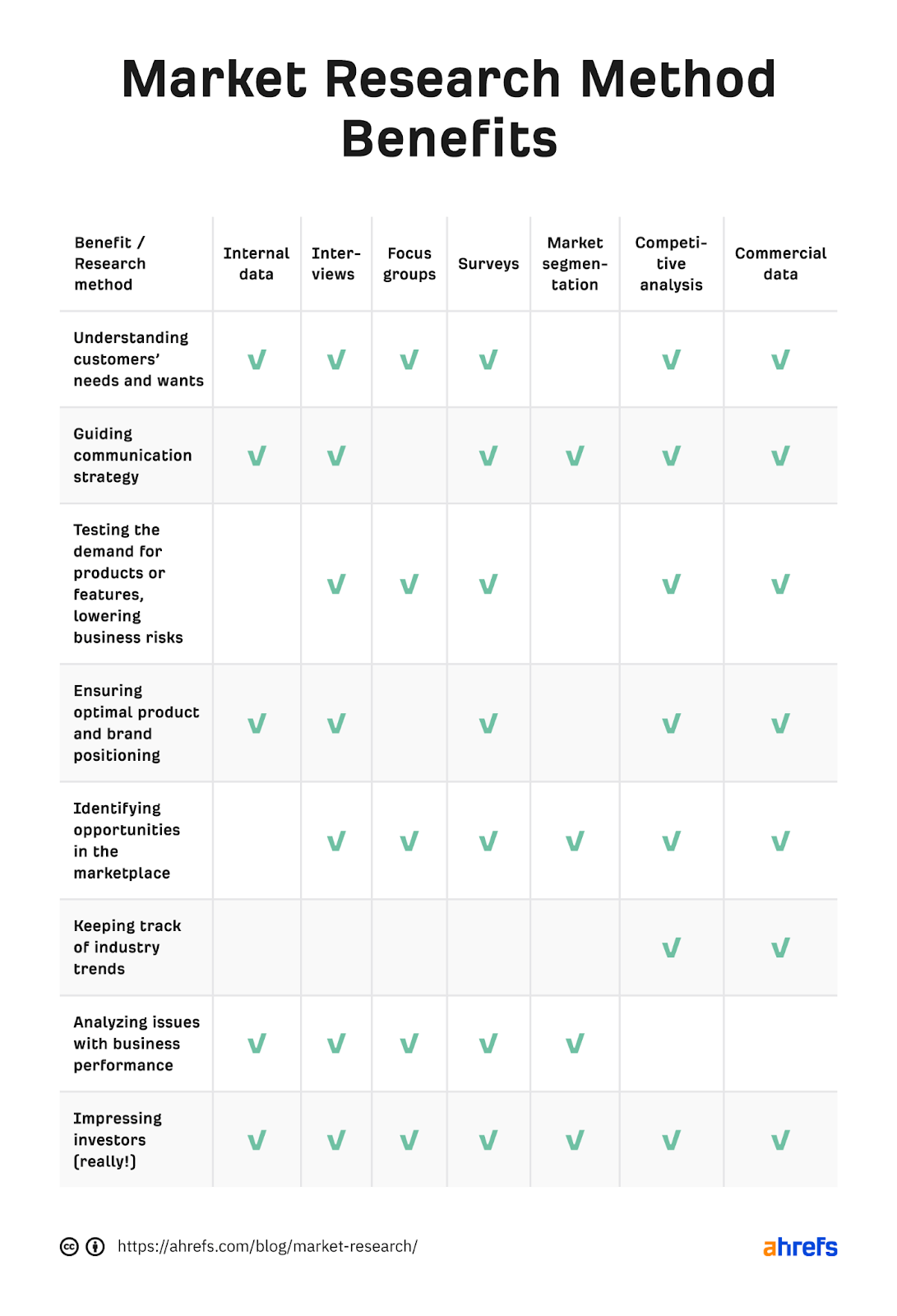

Benefits of market research - a comparison

Let’s quickly summarize the above 7 different methods of market research by their key benefits.

So now we know what market research is, why and when to do it, and we’ve learned about all of the important types and methods.

Let’s see how we can use that knowledge to conduct any type of market research in 5 steps. As an example of market research, I’ll tell you about some of my past experiences with a 3D printing company.

- Identify the market research problem

- Choose the sample and research method

- Collect the data

- Analyze the data

- Interpret and present conclusions

1. Identify the market research problem

This is where every research project starts. You will also find that market research, in general, follows the pattern of the scientific method. First, you need to establish what exactly you are researching.

Do you have a question about your business you want to answer? Maybe you see an opportunity in the market. Or maybe you’ve observed something curious about your product use and you have a hypothesis that you want to validate? State that in the first step of the market research process.

Let me share an example.

In the past, I ran marketing for a few companies, and one of them was a 3D printer manufacturer. Early on I stumbled upon two problems with that company.

First: one of our market segments was saturated with similar products of similar quality at significantly lower price (classic, right?). Second: more and more 3D printing manufacturers seemed to be drifting away from the hobby segment to tackle the professional segments with more expensive products, yet we remained in the hobby/DIY niche. So we were too expensive for hobbyists but too hobbyist for customers who could afford us.

The hypothesis that I wanted to verify was that if the marketplace was showing a trend towards more professional use cases of 3D printing, our company should follow that trend. In other words, I wanted to check the viability of shifting the brand positioning into the professional/premium sector.

2. Choose the sample and research method

We’ve already covered the main types and methods of market research. You should already have a good idea of the differences between primary and secondary research, or whether qualitative or quantitative methods would best suit your needs.

As for the sample of your research, this refers to the portion of the entire data source in question that you will use. For example, if you want to run a survey among your customers, the sample will refer to the selection of customers you will include in your survey. There are a few options for choosing a sample:

- Use the entire data source. Obviously, it’s not a sample per se. Nevertheless, if sending a survey to all of your customers is doable (and reasonable), this is a perfectly good choice.

- Choose a random sample. Systematic sampling is the easiest way to choose a random sample. This is where you select every x/nth individual for the sample, where x is the population, n is the sample. For example, if you want a sample size of 100 from a population of 1000, select every 1000/100 = 10th member of the population.

- Use non-random sampling (the most biased).

- Convenience sampling: choose respondents available and willing to take part in the survey.

- Purposive sampling: choose respondents that in your judgement will be representative or possess some other feature that is important to the research.

- Quota sampling: choose some arbitrary quota of respondents, e.g. 10 non-paying customers, 10 paying small companies and 10 paying large companies.

Back to our example. As a method for verifying my hypotheses, I chose a mix of:

- Primary data:

- Surveys sent to all of our resellers. We wanted to see if they also had seen a paradigm shift in the market and what segment of clients they had encountered the most. We also wanted to know their perspective on the longevity of that trend, and whether they potentially be interested in a more premium version of our product.

- In-depth interviews on the phone with our resellers conducted by our sales team. We used purposive sampling here. Our sample comprised resellers with which we had the best relations (we knew they would be more eager to share).

- Competitive analysis. We were mostly interested in market players who tried to penetrate the professional/industrial segment, so this was our sample (purposive sampling). We were interested in stuff like: what features were they building into their 3D printers, what was their brand positioning, what was their pricing, what language they used to communicate with their target audience, etc.

- Secondary data:

- Wohler’s industry report, anything 3D printing from Gartner and the like, reports by 3D printing services providers, and basically any scrape of serious data we could find (convenience sampling).

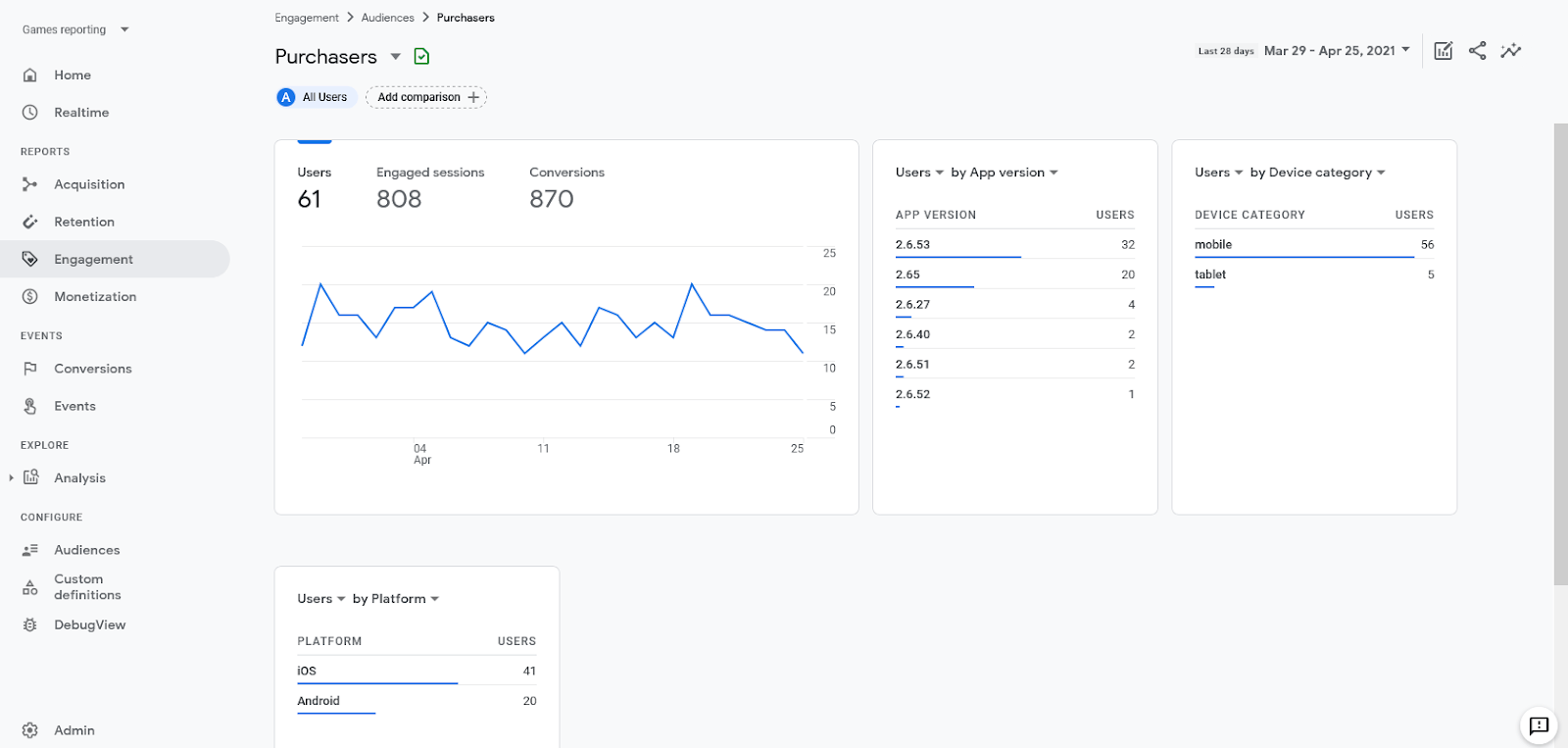

- Internal data: customer satisfaction issues, and just general current customer profile based on Google Analytics and Facebook data.

3. Collect the data

Once you’ve got your problem, method, and sample nailed, all you need to do is to gather the data. This is the step where you send out your surveys, conduct your interviews, or reach out for industry insights.

A word of advice, choose your market research tool carefully; it will greatly influence the amount of work you will have with analyzing the data. For example, Google Forms automatically makes graphs out of quantifiable data (plus it’s free).

Here’s the data we collected for the 3D printing company:

- Primary data:

- Reseller survey data (both quantitative and qualitative data).

- Reseller interview data (qualitative data).

- Customer satisfaction issues (qualitative data gathered through all customer support channels, we analysed about 200 issues and requests).

- Competitive analysis data (from about 10 competitors).

- Secondary data:

- We managed to gather 3 comprehensive, independent industry reports, a few smaller reports made by other 3D printing companies, and dozens of scrapes of data, like statistics and noteworthy insights. We pulled out data like: 3D printer manufacturer market share, market growth in time, market segmentation, key 3D printing applications, 3D printing adoption by region, key players’ sales numbers.

- Any demographic, sociographic and psychographic data on customers and website visitors we could find in our internal data.

4. Analyze the data

Now that you have your data collected, the next step is to look for patterns, trends, concepts, or often repeated words—all dependent on whether your method was qualitative or quantitative (or both).

Simple research performed on a small sample will be relatively easy to analyze, or even analyzed automatically, like with the aforementioned Google Forms. Sometimes you will have to use expensive and harder to master software like Tableau, NVivo, PowerBI, or SPSS. Or you can use Python or R for data analysis (if you have a data analyst or data scientist on board, you’re in luck).

Continuing the example: Google Forms made it easy for us to spot patterns in surveys since quantitative data was calculated automatically. The most time-consuming part was reading through all of the responses and manually looking for patterns (back then I wasn’t aware of any tool that could do the job). Both sales and marketing teams worked on analyzing some of the qualitative data to have more than one reference point.

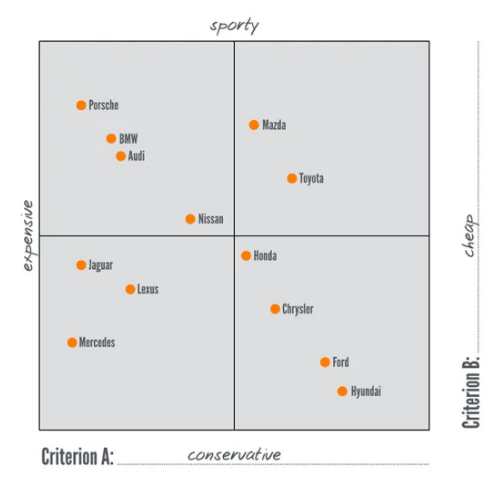

When it comes to researching the competition, coming up with some kind of data structure makes the work more comprehensive (and saner). We put our competitors’ data in specific categories, like products & services (prices included), target market, benefits, values, and brand message. We also used something called a brand positioning map which looks like this:

Analyzing secondary data was probably the easiest part, as the data we needed was already prepared in ready-to-use graphs, statistics and insights. We just had to sift through the contents to look for answers to our questions.

5. Interpret and present conclusions

Analyzing the data is not enough. You need to compile your data in a communicative, actionable way for the decision makers. A good practice is to include in your report: all your information, a description of your research process, the results, conclusions, and recommended actions.

Summing up my 3D printing example, I hypothesised that our market was experiencing a major shift and that the company should follow that trend. The research we did verified that hypothesis positively:

- Our resellers were getting more and more inquiries about professional/industrial use cases and machines. As you can imagine, the budget of this kind of client was significantly higher than hobbyists but so were the expectations.

- Our resellers indicated that this phenomenon is here to stay. Moreover, they declared interest in a new 3D printer tailored to the needs of their more demanding clientele.

- Our customers were outgrowing their early-adopter habits and wanted something easier to use, something plug-and-play that just worked reliably. Tinkering with the printer was something only hardcore makers were interested in.

- The companies we were interested in had already started adapting to the professional/premium market both with their offer and smart marketing communication.

- We also found a ton of other interesting data that we used later on. For example, we found that apart from engineers and designers, an equally interesting segment was educational institutions.

Our initial market research lasted for about two months. We also came back to it whenever we had the chance (or the necessity) and reiterated it to see if we were on the right track.

Was it worth it? Let me tell you this: it saved the company. Our research showed us that this was the last call to reposition the brand and the product. Our original target segment was being gradually dominated by companies we couldn’t compete with.

It took us some time to get buy-in from key stakeholders and implement the conclusions throughout the whole company (eventually, we got it right). As a result, we increased sales, increased customer satisfaction and put ourselves on a more profitable growth track—a win-win for everyone. We even went as far as merging with another manufacturer to shorten the time to get to that sweet market spot.

Looking back, no one from our close competitors survived. They didn’t adapt as we did, and we owed everything to market research.

Whatever you do, avoid these common market research mistakes:

- Poor sampling.

- Ambiguous questions.

- Leading or loaded questions (questions that show bias or contain controversial assumptions).

- Unclear or too many research objectives.

- Mixing correlation with causation.

- Ignoring competitive analysis.

- Allowing biases to influence your research (confirmation bias being arguably the most common and the most dangerous one).

- Not tracking data on a regular basis.

Market research reaches back to the 1930s and it’s probably rooted even “deeper” than the 20th century. Everything you could do then you can do now better, faster and cheaper thanks to these online tools and resources.

SEO tools - research the market with Ahrefs

I’ve put together 3 quick wins that can help with your market research—and that’s only a taste of what you can do with Ahrefs.

1. Brand awareness

In the early 20th century, you’d have to hire market researchers to spend days or even weeks asking people “have you heard about brand X”. Today, you can simply look up the search volume for that brand.

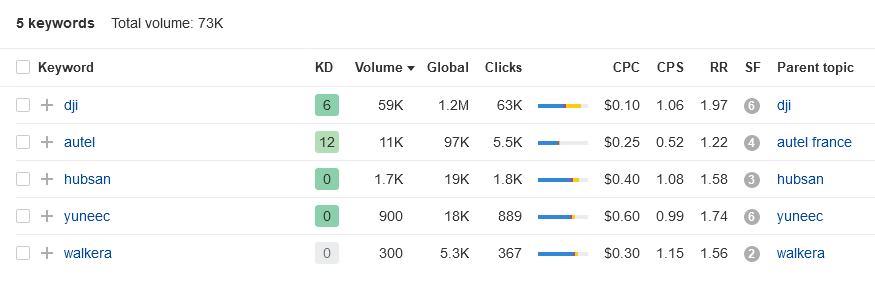

So let’s say you run a drone manufacturing brand, and you want to check out your competitors’ brand awareness in France. Go to Ahrefs Keywords Explorer, input the names of the brands, select “France” as your market, and in a flash you get:

The branded keyword volume indicates the brand awareness of that brand in a particular market. You can also keep track of that data by performing this search regularly to see if there are significant changes over time (for example, impacted by a recent campaign).

2. Feature demand

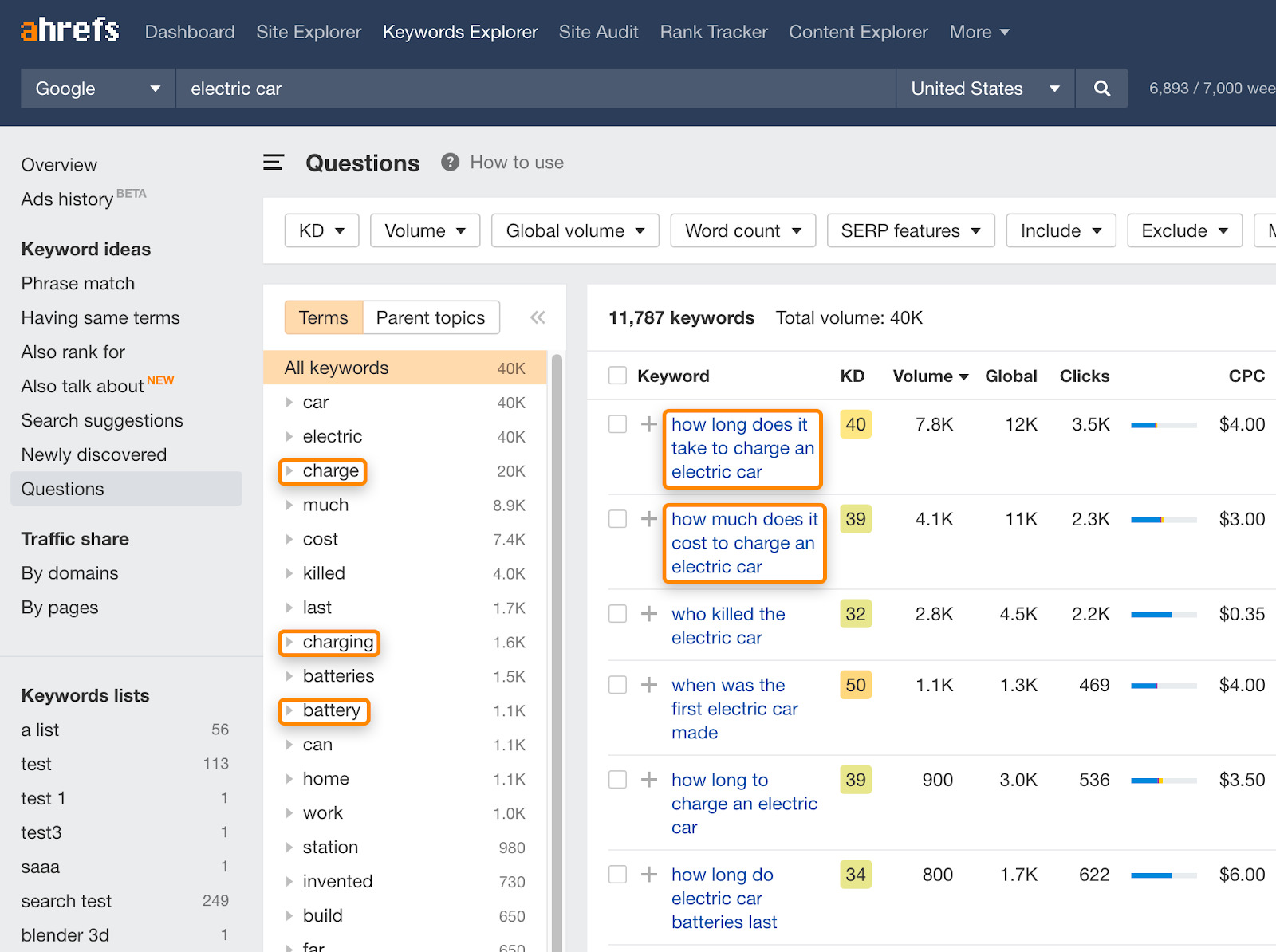

The next game-changing feature for electric cars will concern batteries, charging time, and charging cost (and not autopilot). How do I know?

Well, I opened Ahrefs Keywords Explorer, typed in “electric cars”, and went to the Questions report to find out what people search for. This gave me an idea of what problems electric car owners have (and potential owners worry about). You can easily perform similar research for your niche.

3. Understand the language of your market

Gerald Zaltman in his popular book “How Customers Think” proposes the idea that one of the major erroneous assumptions of marketing is that consumers think in words.

On the other hand, when consumers Google something they have to think in words. And when we market to those consumers we have to think in words as well. The question is: which words?

Let’s say that you want to enter a new and innovative market in the USA, for example the synthetic fermentation-derived dairy industry, also called animal-free dairy.

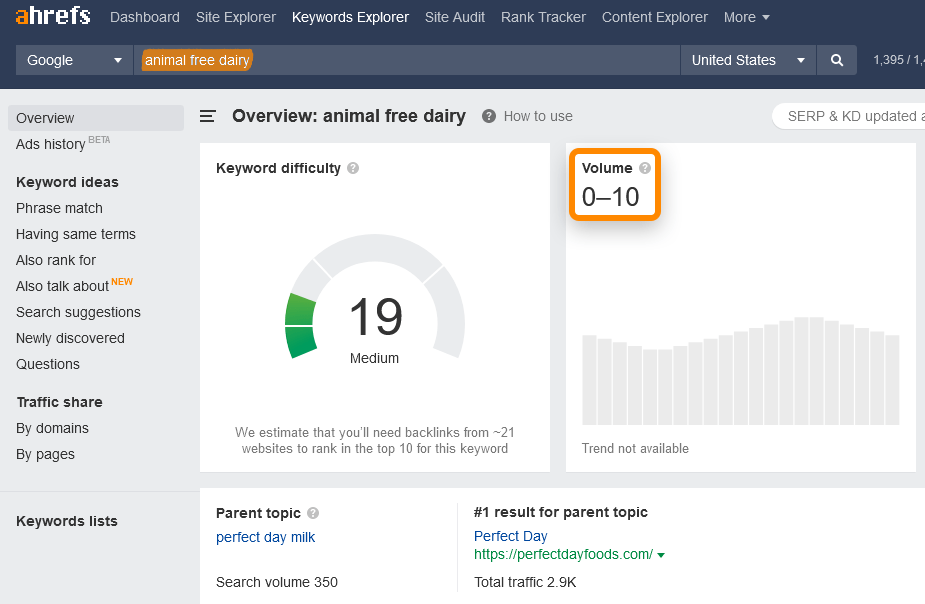

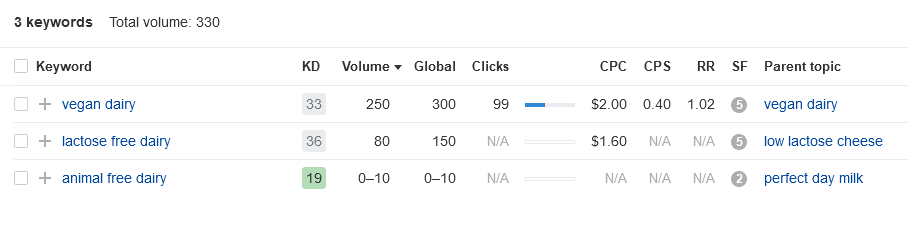

To you, this set of words “animal-free dairy” may be the very center of your business and marketing efforts. But let’s see what other people think. Let’s use Keywords Explorer to see how many people search Google in the U.S. just for that phrase:

Whoops! Looks like your product category has disappointingly low awareness. Does this mean you’re doomed? Not necessarily.

Let’s try other words. Words that mean something different, but still closely related to your new product.

Now we’re onto something. People search for “vegan dairy” and “lactose free dairy” more often. Not the same, but closely related. Yet, look at the difference in search volume.

Words make a huge difference. And Google knows that.

The only reason you were able to put all of those three phrases in the same bucket was that you knew the connection between those words. The problem is that your target audience may not know that connection; they may not even know that this kind of product exists. This quick analysis of search volume shows that you may want to make that connection, for example with content marketing.

If you create content around related higher volume keywords, you can potentially get more organic traffic than simply focusing on the keyword designating your product category. Look, even though you might believe the main benefit of your animal-free product is something unrelated to lactose, e.g., cruelty-free production, you might want to address the problem of lactose intolerance to appeal to people with this condition.

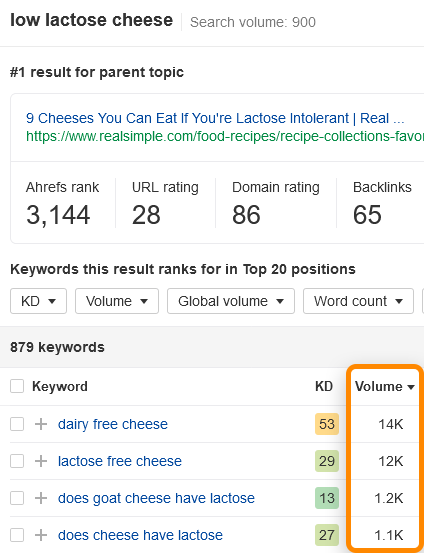

But that’s not all. You may have noticed “low lactose cheese” in the bottom right corner. This refers to the nifty feature of Ahrefs’ Keyword Explorer called “Parent topic”. Parent topic indicates that Google sees a given keyword as part of a broader topic.

If we click on this Parent topic, we uncover even more search demand:

We can see that the search for the topic “low lactose cheese” exceeds the “vegan dairy” topic by almost 300% in the US. Also, uncovering that parent topic gave us 879 potential keyword ideas (some of them have even higher search volume, like “lactose free cheese”).

Want to discover even more topic associations? No problem. You can dive deeper into this research by using other features of Ahrefs’ Keyword explorer. For example,the Also rank for report allows you to see which other keywords (and topics) the top 100 ranking pages for your target keyword also rank for.

This market research quick-win ties into the broader topic of keyword research. If you want to uncover even more keyword ideas and learn how to analyze them, read our keyword research guide.

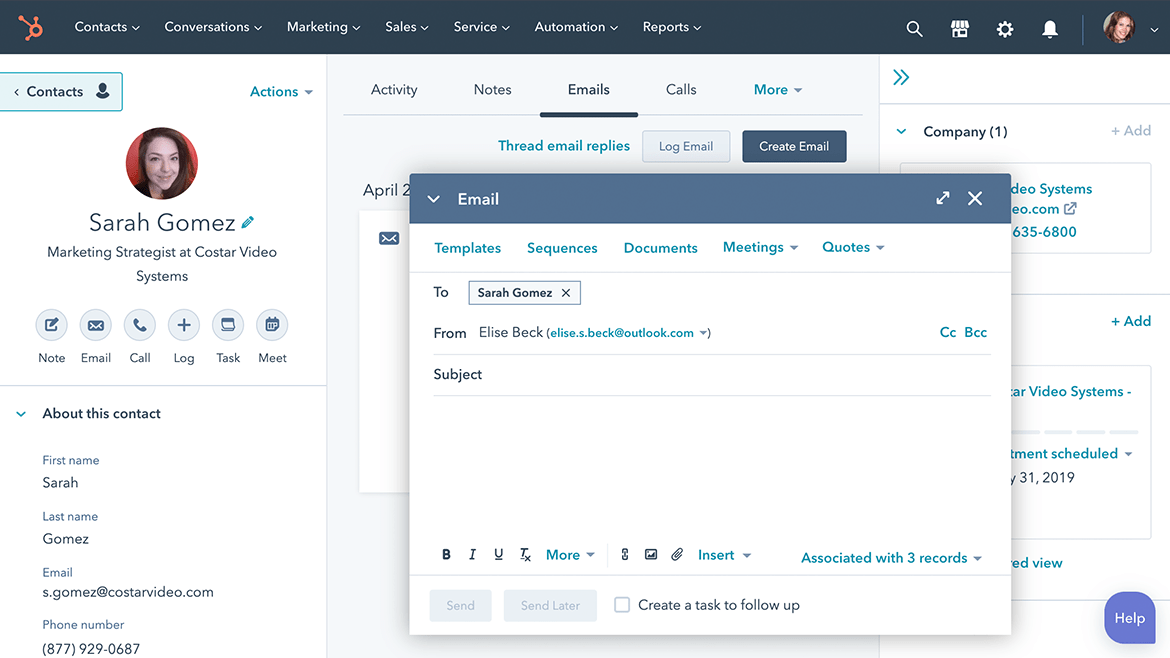

CRMs

Source: https://hubspot.com

Customer Relationship Management software is used to manage and track interactions between a company and its customers and prospects. Usually, it works in tandem with sales or marketing automation software (or has integrations for them). If used properly, it is a true cornucopia of market insight.

As I pointed out earlier, it’s one of those primary data sources that you can leverage to discover patterns in your customer behaviour or characteristics. Popular choices are Hubspot, Salesforce, Intercom, but there is a ton of CRM software out there, so check out a software comparison like G2 to see what best suits your needs.

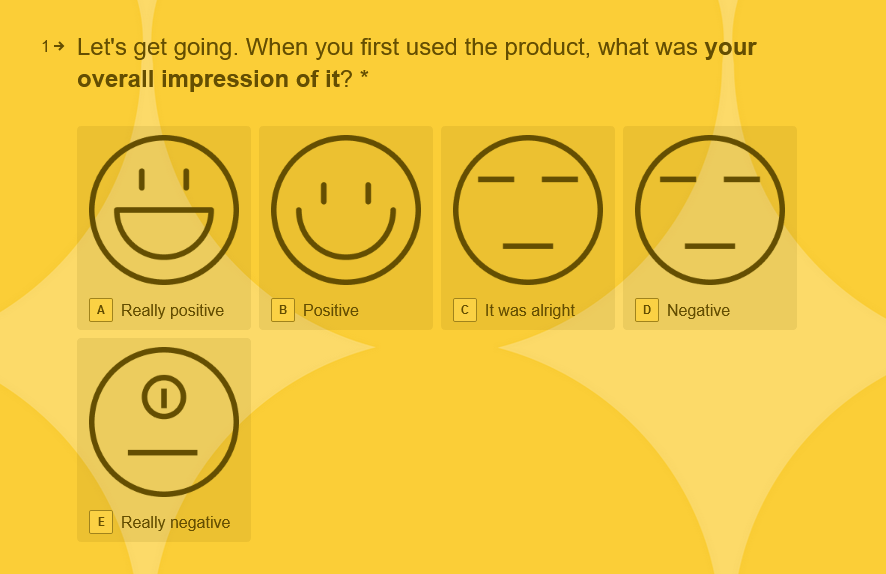

User feedback tools

This type of tool allows you to carry out our aforementioned survey research method online.

Create targeted, user-specific surveys and analyze answers with tools like Google Forms, SurveyMonkey, Typeform, or Qualaroo.

Sending out your typical email with a survey is not the only option, for example with Qualaroo you can display surveys:

- In your digital product

- In your SaaS product

- Inside your web app

- Inside your mobile app

- On your website

- On your mobile site

- On your prototypes.

- On most public URLs. Even competitor sites

Need more? No problem, check out SurveyMonkey’s Market Research solution. It taps into the agile market research models we’ve discussed. They’ve got 14 online solutions that help you stay on top of your game, including customer segmentation, monitoring market dynamics, brand, creative analysis, feature importance, finding the right price for your products, and more.

So you think you have a tough business challenge? This daring gentleman is trying to disrupt… eggs. Extremely hard, but doable with market research on his side.

Website/app analytics

Tracking your website or app traffic is absolute marketing basics. Just look at some data dimensions Google Analytics offers:

- Demographics

- Location

- Behaviour

- Devices

- Channels

Sounds familiar? Yup, that sounds like good ol’ market segmentation. Here’s the best part: it’s free, quick to perform and it’s based on your primary data.

If you’ve never dug deeper into Google Analytics, or similar analytics software (e.g., Matomo, Woopra) here are some questions that this marketing technology can answer for you:

- What do people search for once they’re on my site?

- What differentiates customers who have made a purchase from the ones that haven’t?

- What are my top countries by revenue?

- What are my best selling products?

If you’re already using Google Analytics, see if you’re not making these Google Analytics tracking mistakes.

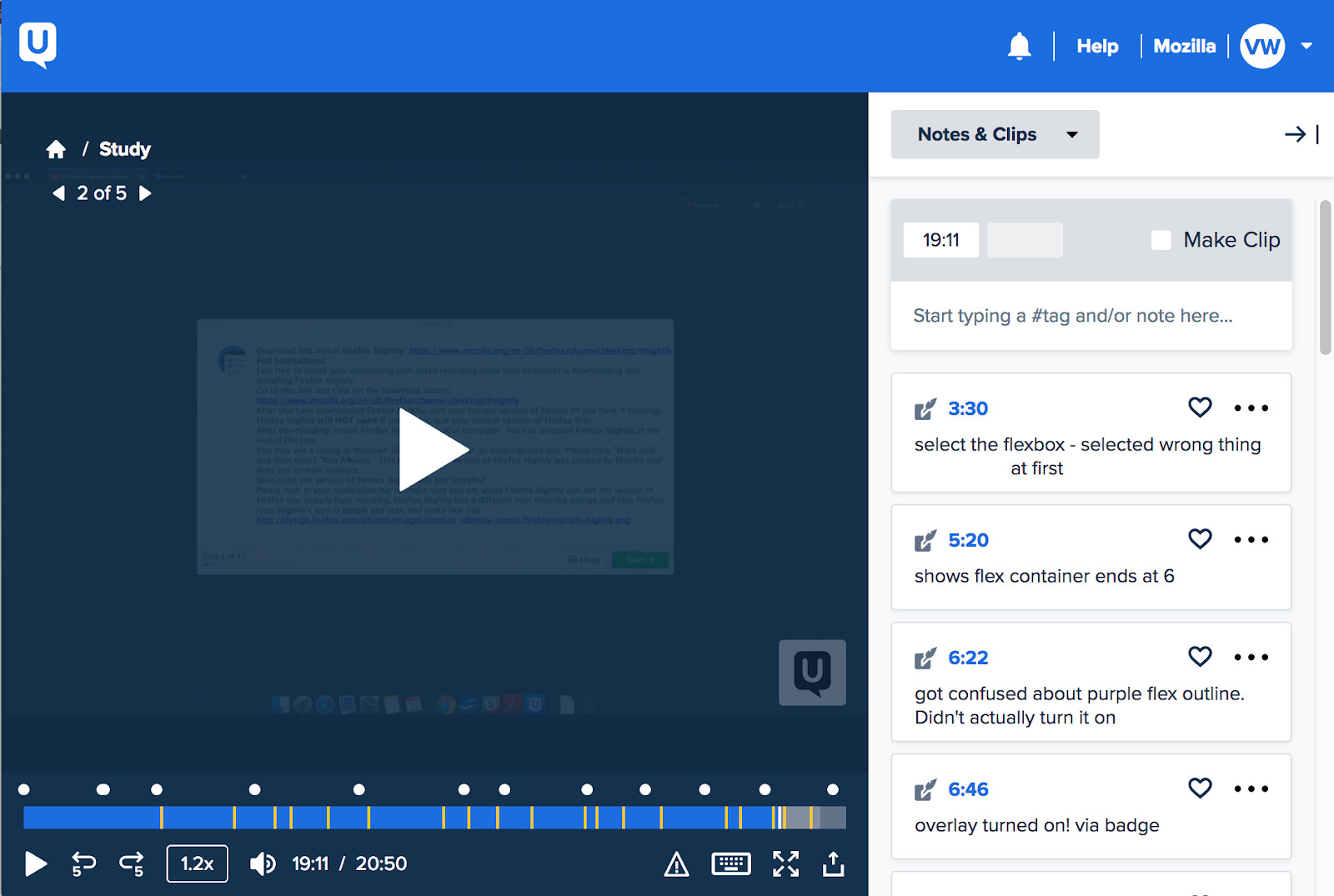

User experience research tools

Commonly used by UX designers, but just listen to the value propositions of these tools:

- “See and hear real people using your website, online shop or app.” (https://userpeek.com/)

- “Real-time feedback. From real customers. Wherever you work. So you can create experiences that get real results.” (https://www.usertesting.com/)

- “Scalable & Customized User Research” (https://www.userlytics.com/)

- “Record video and audio of your users, so you see and hear their exact experience with your product.” (https://www.loop11.com/)

Again, sounds much like our market research methods, right? And it’s no joke, thousands of companies use these tools.

User experience research tools allow you to get user feedback and insights on your products, prototypes, websites, and apps.

Testing is based on tasks your test-takers perform. You can either use your own user base or define a custom base using their services. You’ll get written reports and even recorded videos that you can incorporate into your market research and make sure you’re properly taking advantage of that market opportunity.

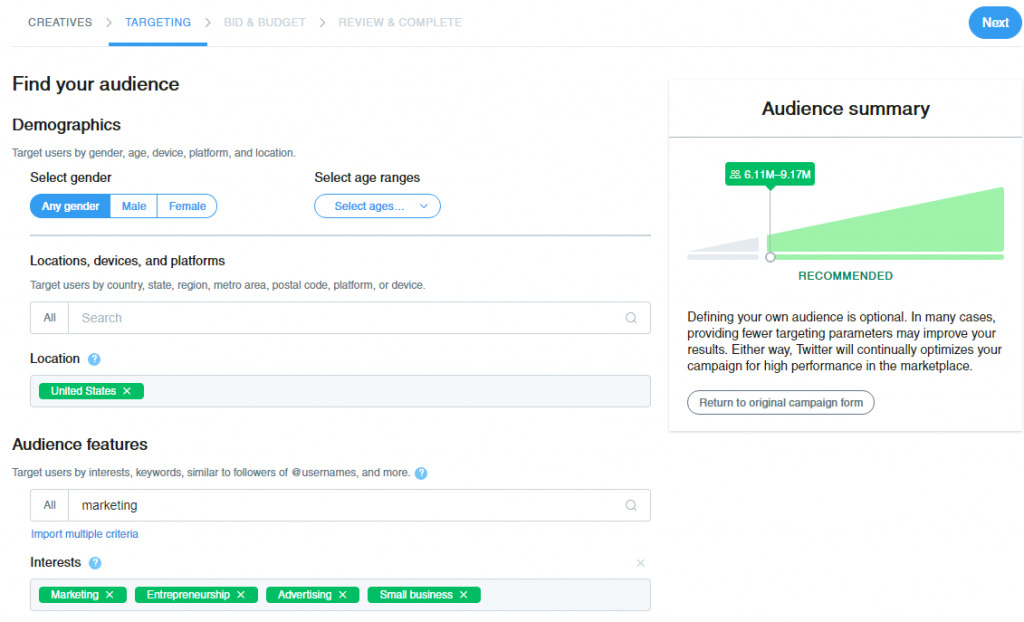

Ad planning tools

That’s right—the Facebook, LinkedIn, and Twitter ad planner you already use for running ads can give you some insight into the numbers behind the market segments you’re interested in.

30+ males with higher education interested in technology gadgets? No problem. Female C-suite decision-makers from Europe? It’s all there.

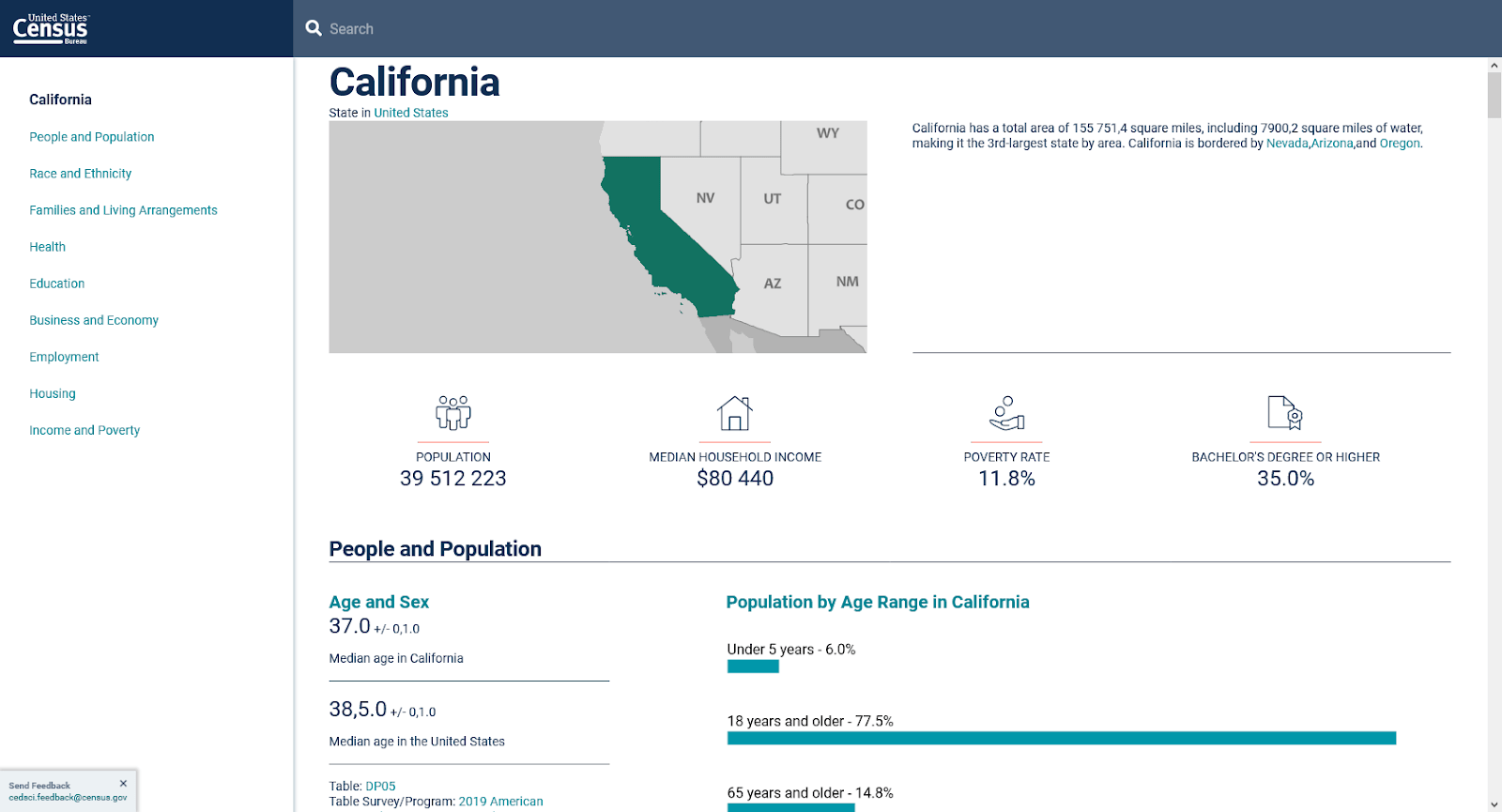

Census data

The availability of this kind of data may vary based on your target market. For example, in the US the Census Bureau offers a free resource for searching the country’s census data. You can filter the data by topics, years, geography, surveys, or industry codes. You can also access premade interactive tables (which you can also download) or simply explore certain regions of the country using their maps.

Business intelligence tools

With business intelligence tools like Tableau, Looker or Sisense, you can connect to any data source to perform data cleaning, statistical operations, and data visualization. They are designed to allow you to glean insights into your data, and communicate effectively with your stakeholders. It’s like SQL combined with R, but you don’t need coding skills and you get a user-friendly interface.

Because these tools are overflowing with functionality and because they are usually pricey, they are overkill for small companies with basic market research needs. Often you will find that the tool that you are already using for your research method comes with some data analysis and visualization functions. And if not, you can always import your data to Excel or Google Docs and use Google Data Studio for a shareable interactive presentation.

Other noteworthy tools and services

Final thoughts

Market research is no easy feat. If you feel intimidated by it, you’re not the only one. But don’t shy away from it. The benefits of conducting even sporadic market research can have benefits for your business you simply can’t ignore. You won’t turn into a market research pro overnight, but the good news is you don’t have to. You can go the agile way (like Ahrefs), use affordable self-service online tools and resources, or you can even outsource your research. As long as you base your marketing game plan on valid data, you dramatically improve your chances for success.

Got questions? Ping me on Twitter.